Growing Confidence in Bitcoin ETF Leads to Biggest Increase in Assets Since Late 2021

Growing Anticipation of a US Bitcoin ETF Continues to Spur Inflows into Digital-Asset Investment Products

Anticipated US Spot Bitcoin ETF Leads to Historic Inflows

Investors are showing increasing interest in digital-asset investment products, driven by growing anticipation of an eventual US spot Bitcoin exchange-traded fund (ETF). This optimism has led to inflows for these products for a ninth consecutive week, marking the largest run since the crypto bull market in late 2021.

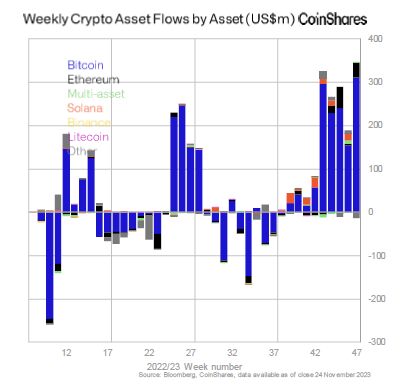

Inflows totaling $346 million were recorded last week, with Canada and Germany contributing to 87% of the total, according to CoinShares. Conversely, only $30 million came from the US, indicating continued low participation from the country, as highlighted in a report released by the asset-management firm on Monday.

Rising Prices and Inflows Push Total Assets Under Management to $45.3 billion

Since early October, the crypto market has experienced a surge as traditional asset managers, such as BlackRock, have made preparations for spot Bitcoin ETFs. If approved by the US Securities and Exchange Commission, these ETFs have the potential to bring in a plethora of new investors into the asset.

In response to this growing anticipation, the total assets under management have surged to $45.3 billion, reaching the highest level in over one and a half years, according to the report.

Strong Inflows for Bitcoin and Ether Products

Bitcoin products have proved to be particularly popular, with $312 million in inflows recorded last week, pushing total inflows to over $1.5 billion since the beginning of the year. On the other hand, Ether products saw $34 million in inflows last week, effectively negating the outflows experienced in all of 2022.

The Ripple Effect of ETF Anticipation

The anticipation surrounding the potential approval of a US spot Bitcoin ETF is having a ripple effect on the broader digital-asset investment landscape. It has sparked a renewed enthusiasm among investors, resulting in increased inflows and rising total assets under management for digital-asset investment products.

As the market awaits a decision from the US Securities and Exchange Commission, it is clear that the promise of a Bitcoin ETF is already having a significant impact on the digital-asset investment landscape, with far-reaching consequences for the market as a whole.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years. I have a wealth of knowledge to share with my readers, and my goal is to help them navigate the ever-changing world of cryptocurrencies.